Based: the all-in-one app on HyperLiquid

There’s a familiar cycle in crypto: every few quarters, someone launches another DeFi superapp for normal people.

Then you open it and find twelve buttons, six networks, and a gas prompt. Based breaks that pattern—not by inventing a new buzzword, but by quietly delivering something that feels finished.

Built on Hyperliquid, a lightning-fast Layer-1 engineered for on-chain trading, Based wants to bridge the gap between exchange convenience and blockchain principles.

It looks like a polished fintech app. It behaves like a decentralized protocol. And beneath the surface, it’s testing one of DeFi’s most persistent hypotheses: that people don’t hate decentralisation—they just hate bad UX.

DeFi without the friction

Most decentralized exchanges (DEXs) still feel like prototypes—powerful but awkward. Based starts from the opposite angle: design for the user first, and make decentralisation the invisible default.

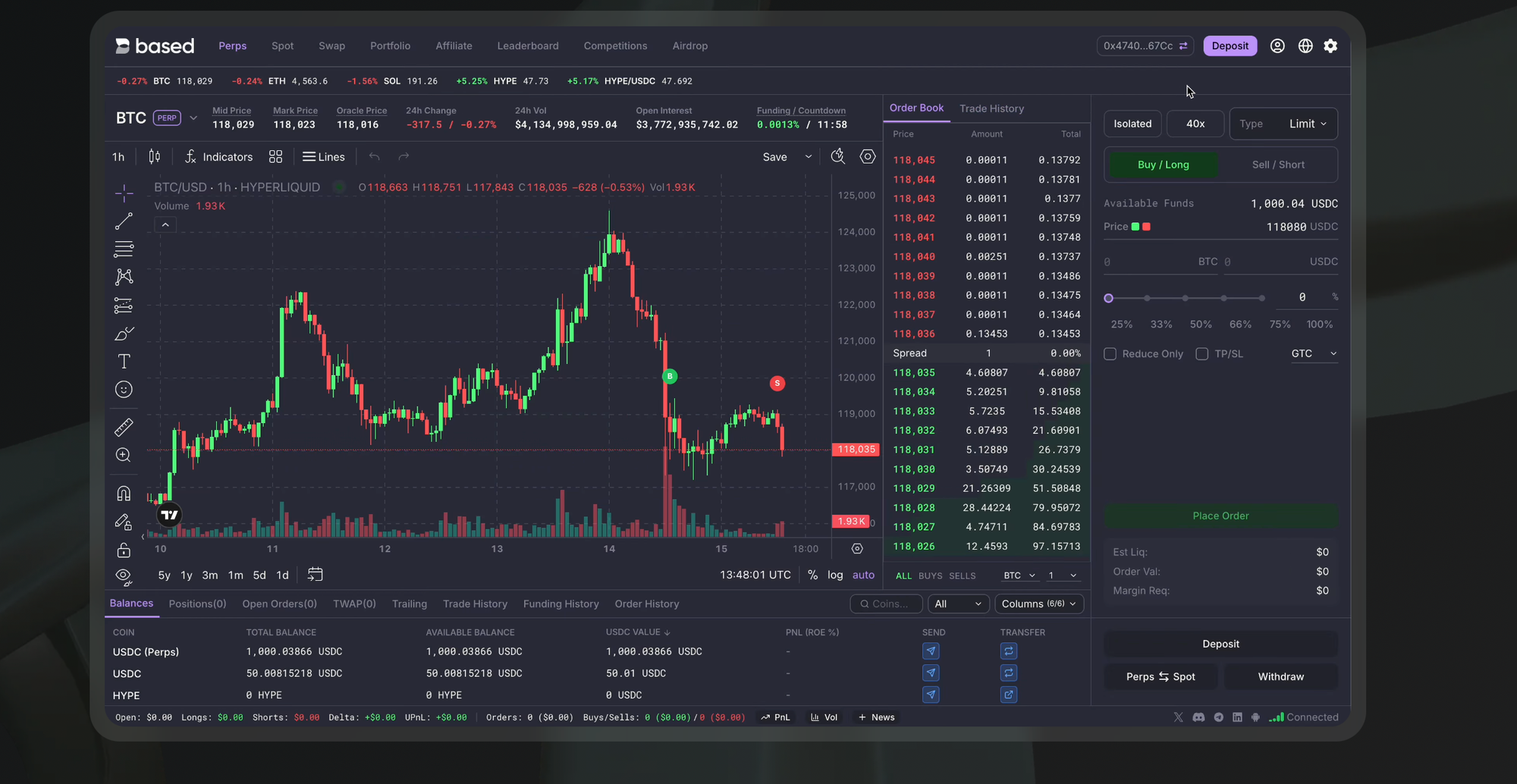

It lets anyone trade spot markets and perpetual futures directly through Hyperliquid’s on-chain order book, which is more than a technical flourish.

Every order, match, and cancellation happens transparently on-chain. No off-chain servers. No hidden books. The system runs through HyperCore, Hyperliquid’s real-time matching engine that keeps all state on-chain while maintaining CEX-level speed.

Latency? Around 200 milliseconds. Throughput? Hundreds of thousands of orders per second, scaling past a million. That’s the kind of performance centralised exchanges brag about—except Hyperliquid does it publicly, verifiably, and deterministically.

This is what enables BasedApp to deliver a full trading suite—perpetuals, spot, portfolio tracking—without the usual compromises or delayed settlements.

Hyperliquid under the hood

To understand Based’s elegance, you have to understand Hyperliquid’s design philosophy. It’s not another EVM chain with fast blocks, rather, it’s a chain purpose-built for financial state.

Its dual-block architecture separates small, fast blocks (for orders) from slower, large ones (for contracts).

The result is speed where it matters and capacity where it counts. Consensus runs through HyperBFT, a proprietary low-latency protocol achieving near-instant finality.

Then there’s HyperEVM, a fully compatible Ethereum execution environment that allows standard DeFi contracts to live directly on Hyperliquid. This gives Based composability with existing DeFi primitives—lending, staking, tokenised yield—without leaving the ecosystem.

The synthesis is striking: a vertically optimised trading chain that still plays nicely with the horizontal world of DeFi.

The User Experience: From Trade to Tap

DeFi’s Achilles’ heel has always been the user journey. Based reconstructs it from scratch.

You download the mobile app, sign in with an email or Google account, and within seconds, you have a self-custodial wallet. No seed phrases, no Chrome extensions. The private key is generated locally—yours, not theirs.

From there, you can trade spot pairs or perpetuals powered by Hyperliquid’s order book. Execution feels instantaneous; confirmations are invisible. It’s DeFi trading that doesn’t feel like DeFi.

But Based true innovation might be what happens after the trade. The app integrates a Visa Debit Card, available in selected markets, letting users spend their crypto balances anywhere Visa works.

Behind the scenes, the card pulls directly from your on-chain balance, converting in real time. In a sense, Based doesn’t just bridge DeFi to TradFi—it stitches them together.

Add to that a portfolio dashboard that aggregates balances across spot, perps, and EVM assets, and you get something that resembles a neobank dashboard—but one that lives entirely on public infrastructure.

Basedpad and the builder loop

DeFi protocols rarely think like ecosystems. Based does. Basedpad —a zero-fee launchpad for new Hyperliquid projects—serves as both community incentive and ecosystem catalyst.

Any project can list, raise liquidity, and launch directly to Hyperliquid users through Based’s interface. No gatekeeping, no hidden listing fees. In practice, it functions like an on-chain incubator, pulling developers and traders into the same loop.

This dual-role approach (consumer front-end + infrastructure gateway) positions it not just as a trading app, but as the interface layer of Hyperliquid’s growth strategy.

And it’s working. According to recent reports, Based has risen to among the revenue generators on the network, which is pretty significant for a product still in early release.

Takeaway

If the last cycle of DeFi was about composability and the next about real yield, this one is about invisible infrastructure. Based embodies that transition by not asking users to switch wallets, learn jargon, or bridge to yet another L2.

It’s giving them a single interface that trades, pays, and holds—while the blockchain hums quietly underneath.