hello, defi

2026 will be a turning point, the year decentralized finance and stablecoins mature into real financial infrastructure.

After a decade of experimentation, we are seeing the emergence of how blockchains underpin how money moves, grows, and interacts across borders. The vision of an open, programmable financial internet is no longer theoretical—it is operational.

Stablecoins as the core of global liquidity

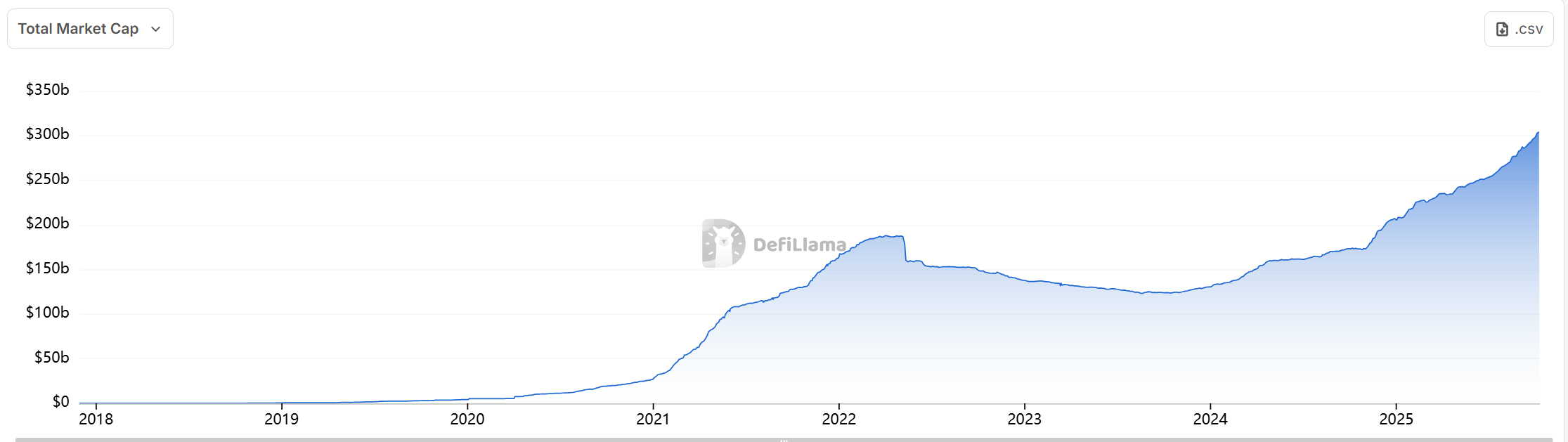

Stablecoins have become the primary medium for settlement, savings, and trade. Their market capitalization has crossed almost US$350bn dollars, but their real importance lies in ubiquity, not valuation.

In Latin America and Southeast Asia, stablecoins such as Circle's USDC and PayPal's PYUSD have become default digital cash. Businesses pay suppliers, workers receive wages, and consumers transact across borders without banking intermediaries.

Cross-border payments, once riddled with friction and delay, now settle instantly on chains like Solana and Base. Circle’s integration with Visa and Stripe makes it possible to settle invoices or payrolls in seconds, bypassing the legacy rails of SWIFT and correspondent banking.

Fintechs like Revolut, Payoneer, and GrabPay have adopted stablecoin rails for faster settlement and remittance, reducing costs by over 90%.

This shift has quietly redefined what a dollar is. The world’s reserve currency now moves natively on open ledgers, without gatekeepers. Stablecoins have not replaced banks—they have made them faster, cheaper, and globally interoperable.

Beyond remittance, stablecoins are now used in consumer savings, business accounting, and treasury management.

Startups use them to hedge local currency exposure. Retail users store income in stable-yielding accounts that outperform traditional deposits. Corporations use stablecoins to manage cross-border liquidity, automate payroll, and handle supplier payments with programmable settlement conditions.

Yield as utility

Interest on digital assets is no longer an exotic concept. Tokenized treasuries, money markets, and credit pools have transformed yield into a transparent and programmable layer of finance.

Platforms such as Ondo Finance issue tokens backed by short-term government securities, delivering real yield to users who want stability without exposure to volatile crypto assets.

Apps now abstract the complexity. A user might hold a yield-bearing USDC balance in a fintech wallet without ever realizing it’s earning from tokenized U.S. Treasuries on-chain.

Products like Superstate and OpenEden offer institutional access to compliant on-chain treasury markets, bridging traditional and decentralized finance.

Protocols like Morpho and Aave V3 have evolved into liquidity engines that power hundreds of fintech applications, offering optimized lending and borrowing behind the scenes.

Yield has become part of everyday financial infrastructure—a quiet, background function like interest on a savings account, but fully transparent and composable.

DAO treasuries use real-world yield to fund operations sustainably. Consumer wallets allow instant conversion of idle balances into income-generating assets without user friction. Yield has become a system function, not a product.

Settlement and liquidity infrastructure

DeFi has quietly become the universal settlement layer. Institutional networks such as JPMorgan’s Onyx use public blockchain standards for cross-border settlements.

Central banks are piloting interoperable digital currencies that clear through stablecoin-backed liquidity pools, bridging the gap between public and private money.

Merchant payments, treasury operations, and securities settlements now move on the same rails. An exporter in Vietnam receives payment instantly from a buyer in Germany through Circle’s USDC integration on Solana.

Treasury desks in multinational firms manage stablecoin liquidity alongside fiat cash, optimizing yield and settlement speed in a single dashboard. The efficiency gains—seconds instead of days, and costs reduced by more than 90%—speak for themselves.

All powered by invisible infrastructure

The financial layer of the internet has become invisible. In fact, most users do not need to understand smart contracts or private key management.

Account abstraction and compliant custodial models allow individuals and institutions alike to interact with decentralized infrastructure through interfaces that feel familiar. Fintechs are now building directly on-chain, embedding programmable money into products people already use.

Stablecoins, tokenized assets, and lending protocols are no longer seen as Web3 experiments. They are quietly powering global payrolls, credit markets, and investment flows. Every on-chain transaction that replaces a legacy settlement process reinforces a larger truth: finance is being rebuilt on transparent, interoperable, and programmable foundations.

The financial internet emerges

We believe that stablecoins will soon serve as the universal settlement medium while tokenized yields provide programmable savings. The outcome is a more efficient, inclusive, and resilient global economy—one where value moves as freely as information.