HyperLiquid or hype

When DeFi began, everything felt possible: permissionless money, composable primitive contracts, financial plumbing open to anyone who could write a transaction.

The reality, however, has a way of insisting on hard constraints. Traders demanded speed, market makers wanted predictable execution, and institutions asked for rules.

Centralized exchanges answered those needs with raw engineering and centralized control; most decentralized venues answered with either clever economic hacks or slick front ends.

Hyperliquid is trying a different route: it’s not a DEX that dresses like a CEX, nor a CEX that glues on a token. It’s a purpose-built Layer-1 whose raison d’être is market infrastructure—order books, matching, margin, and perpetuals—implemented on-chain and optimised for the rhythms of real trading.

Why build a new chain for derivatives?

It’s tempting to think an order book is just software. But markets are a systems problem. Matching engines, risk engines, margining, and real-time data need determinism and latency guarantees that most L1s never prioritized. AMMs solved liquidity for passive spot trading, but they don’t mimic the behavior of order books in stress events, and they’re awkward for sophisticated order types. Hyperliquid’s basic thesis is pragmatic: if you want derivatives that behave like derivatives, you should optimize the stack for them.

So Hyperliquid built HyperCore—the trading spine that keeps order books and margin state on-chain—and HyperEVM, an Ethereum-compatible execution environment that shares the same state. The advantage is straightforward: developers don’t have to bridge comprehension gaps between an off-chain matching engine and on-chain contracts. The order book is first class. The smart contract environment and the matching engine live in the same clock domain. That reduces reconciliation windows, eliminates a large class of race conditions, and gives creators tools for building composable financial products that can observe, respond to, and participate in liquidity in real time.

Underpinning it all is HyperBFT, a consensus variant tuned for low latency and high throughput. The team’s numbers—fractions of a second for median confirmation, tens to hundreds of thousands of orders per second in practical regimes—aren’t academic. They matter. Traders trade because latency kills opportunity; market makers provide tighter spreads when they can enter and exit quickly. Hyperliquid is designed to get both sides of that equation into the same on-chain model.

The product in practice: what traders and builders actually get

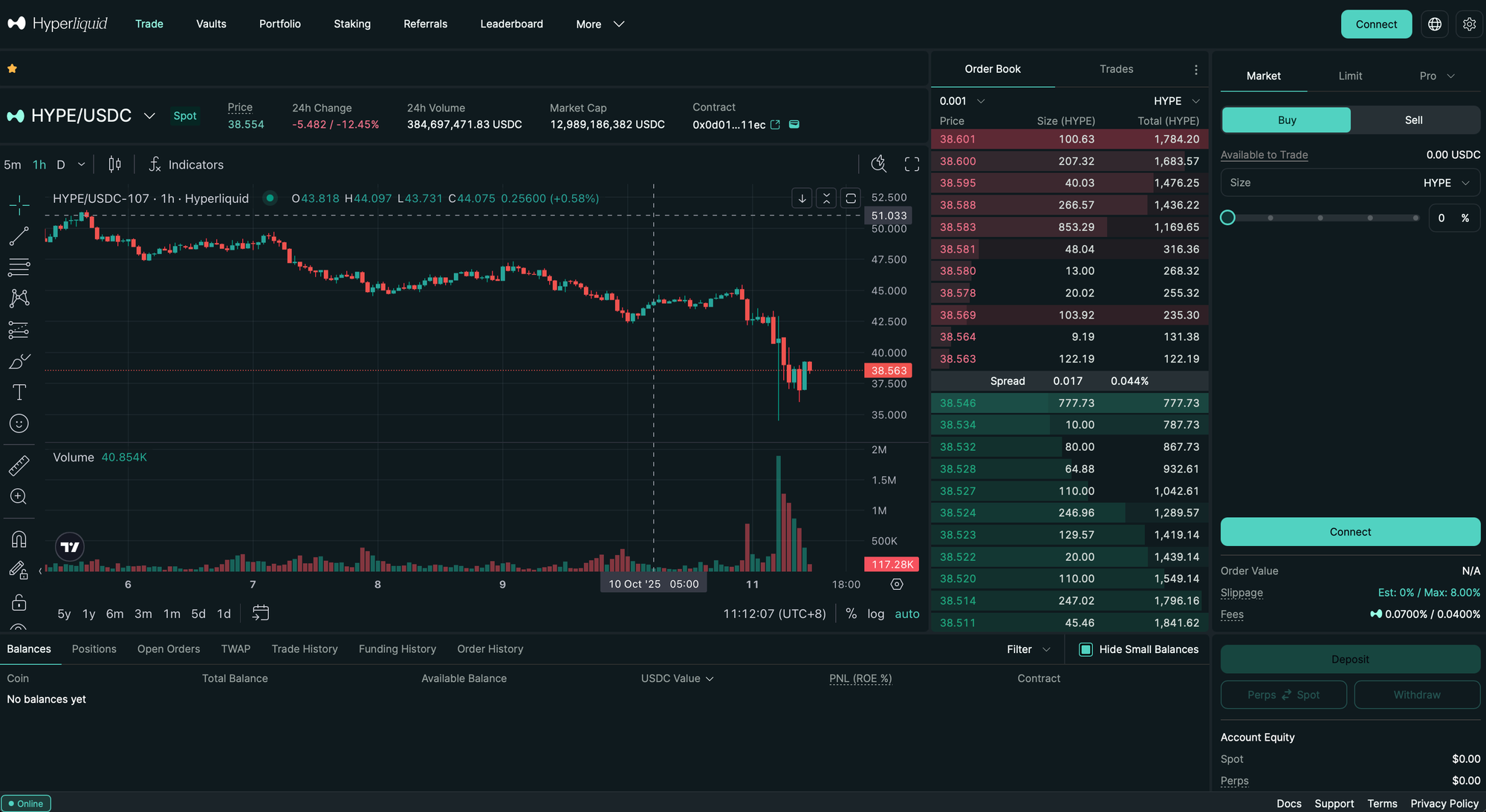

Hyperliquid’s product smells like a trading desk. You get true order books rather than AMM pools, with the sorts of advanced order types traders expect: limit and market orders, stop-loss and take-profit, TWAP, and scaled entries.

You can run strategies that require deterministic settlement and transparent fills. Importantly, the platform’s native perpetuals that don’t necessarily depend on external spot feeds—demonstrate the protocol’s ambition to own the discovery process rather than outsource it to oracles.

For liquidity providers there are vault constructs that democratize market making. You don’t need an HFT stack in a data center to provide liquidity; instead you expose non-custodial capital into vaults that execute strategies inside the matching engine.

That’s a simple sentence with complicated implications: if capital can participate as protocol-level liquidity, order-book depth can become distributed and composable, rather than captive to a few centralized firms.

For builders, the benefit is composability at market speed. HyperEVM compatibility means you can write Solidity and deploy contracts that reference the same on-chain order book state. That opens possibilities for derivatives primitives that settle instantly and for secondary markets that don’t have to reconstruct price feeds from external aggregators.

Wallets, analytics providers, and traders can stream market data in near real time; APIs and node services give the developer experience some of the immediate characteristics of working with a CEX.

$HYPE

Hyperliquid’s HYPE token is structured to be functional rather than theatrical. Staking, fee reductions, validator selection, and participation rewards are the levers.

HyperLiquid's approach to distribution—heavy user orientation through retroactive allocation and emissions tied to activity—signals a preference for aligning tokens with usage instead of fast-flip speculation.

This design aligns incentives: traders generate volume, fees flow into the system, vaults capture liquidity fees, and stakers secure the network. Governance is deliberately pragmatic. Because this is derivatives infrastructure—where parameters like leverage caps and liquidation thresholds are safety-critical—the protocol opts for a technocratic governance posture: rigorous proposals, staged rollouts, and an emphasis on safety over headline governance theater.

Risk and the hard parts of the trade

No technical design removes risk; it only reshapes it.

Hyperliquid’s major exposures are human and infrastructural. Running matching logic on-chain amplifies the attack surface: a bug in the matching engine or liquidation code has more consequences when it executes deterministically at high frequency.

Oracle manipulation, although mitigated by internal price discovery in many markets, remains a vector for assets dependent on external references. And the validator set tradeoff is real: low latency favors smaller, carefully curated validator sets, which in turn raises concerns about decentralization and censorship resistance.

Operational trust is another frontier. Traders care about uptime, about reliable withdrawals, about edge cases that push a chain into stressed behavior. Hyperliquid’s early volumes—and its ability to process heavy load—are promising, but the peculiarities of real markets (flash crashes, sudden liquidity withdrawal, regulatory interventions) will be the true stress tests.

Also, UX matters. Even the most elegant on-chain matching is undermined if the front end confuses users, or if migration between spot and perpetual accounts is clunky. Some of the community feedback has focused precisely on those friction points: recovery flows, flagged addresses, and nuanced interface behaviors that matter when money is at risk.

Where Hyperliquid sits in the competitive landscape

There are two competitors for any trader: other DEX models and centralized venues. AMM-based perp platforms are cheaper to build but cannot mimic the tight spreads and advanced order semantics native to order books.

Centralized exchanges have efficiency but sacrifice transparency and custody. Hyperliquid tries to synthesize the two: near-CEX execution semantics with on-chain guarantees.

Rivals like Aster and Lighter pursue adjacent ideas—higher throughput, derivatives on alternative stacks—but Hyperliquid’s explicit decision to own the stack (chain plus matching engine plus EVM compatibility) is distinctive.

That presents both a moat—technical integration that’s costly to replicate—and a concentration risk: building a chain and an exchange is heavy engineering work, and success depends on execution across a dozen complex dimensions at once.

If Hyperliquid succeeds in delivering reliable, deep, on-chain order books, the second-order effects could be significant.

Wallets could surface derivatives trading as a seamless feature. Lending markets could use live order book prices for sharper liquidation engines. Option desks could underwrite positions more confidently knowing there is tight perp liquidity to hedge into. Builders could compose derivatives services without stitching together oracle latencies and off-chain matching windows. Composability would stop being aspirational and start being operational.

The verdict

Hyperliquid is not a speculative toy; it’s an infrastructural wager. Its thesis—that real markets need on-chain order books and a chain optimized for the job—is coherent and increasingly supported by usage.

The protocol’s design choices are deliberately conservative where safety matters and boldly experimental where speed pays. That is a rare balance in crypto.

We are, frankly, at the edge of something infrastructural rather than fashionable. Hyperliquid’s promise is not to be the loudest protocol in town but to become the least visible: the plumbing everyone depends on but never mentions.

If that sounds boring, welcome to the future that actually makes markets work. If it works, you won’t notice the technology; you’ll only notice that trading became easier, faster, and more transparent. And that, after all the rhetoric, may be the most radical thing of all.